The ending cash balance on the cash flow statement (CFS) must match the cash balance…

Financial Statement Preparation Example Explanation of Steps

Ratio analysis is a fundamental tool in financial statement analysis that involves calculating various financial ratios to assess a company’s performance, liquidity, solvency, and efficiency. These ratios include liquidity ratios, solvency ratios, profitability ratios, and efficiency ratios. Materiality is an accounting concept that refers to the significance of a piece of information or a transaction. An item is considered material if its omission or misstatement could influence the economic decisions of users based on the financial statements.

Link to Learning

We will discuss the financial statement form in the next section of the course. This method ensures that financial statements provide a more accurate representation of a company’s financial performance and position. Your statement of retained earnings, or statement of owner’s equity, lists what your business’s retained earnings are at the end of an accounting period. Retained earnings are profits you can use to pay off liabilities or make investments. If the debit and credit columns equal each other, it means the expenses equal the revenues. This would happen if a company broke even, meaning the company did not make or lose any contribution margin money.

Step 2: categorize and organize the data

In other words, the concept financial reporting and the process of the accounting cycle are focused premium vs discount bonds on providing external users with useful information in the form of financial statements. These statements are the end product of the accounting system in any company. Basically, preparing these statements is what financial accounting is all about.

Under US GAAP there is no specific requirement on how accounts should be presented. IFRS requires that accounts be classified into current and noncurrent categories for both assets and liabilities, but no specific presentation format is required. Thus, for US companies, the first category always seen on a Balance Sheet is Current Assets, and the first account balance reported is cash. The accounts of a Balance Sheet using IFRS might appear as shown here. For example, IFRS-based financial statements are only required to report the current period of information and the information for the prior period. US GAAP has no requirement for reporting prior periods, but the SEC requires that companies present one prior period for the Balance Sheet and three prior periods for the Income Statement.

- If you check the adjusted trial balance for Printing Plus, you will see the same equal balance is present.

- We will discuss the financial statement form in the next section of the course.

- Preparing financial statements is a crucial skill to learn for any founder.

- It records transactions when they are incurred, regardless of when the cash is exchanged.

- If the debit column were larger, this would mean the expenses were larger than revenues, leading to a net loss.

- She still prefers iced coffee over tea, but has a new soft spot for a Sunday roast.

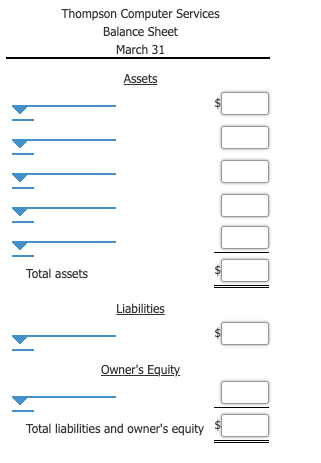

Step 3: Prepare the Balance Sheet

Use the formula above to help calculate your retained earnings balance at the end of each period. Accrue an income tax expense, based on the corrected income statement. Ideally, the income tax rate should be based on your estimate of the average tax rate that will apply for the entire fiscal year. Compare the shipping log to accounts receivable to ensure that all customer invoices have been issued.

The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock. Last week we outlined the four primary types of financial statements. These statements include the cash flow statement, the balance sheet, income statement, and the statement of retained earnings. These statements are essential for assessing the current state of your business’s finances, as well as projecting future earnings. However, to accurately receive your financial information, you must process your financial statements in a specific order.

Balances of current liabilities like what is a net lease defining real estate investment terms accounts payable and long-term liabilities like bonds appear here. Other comprehensive income refers to gains and losses that don’t appear on the income statement because the company hasn’t realized them yet. Remember that the trial balance doesn’t find other types of errors such as amounts posted in the wrong account. You may need to post adjusting entries before you start closing your accounts. Adjusting entries are generally for unrecognized income or expenses for the period.

Once finalized, the financial statements are presented to the company’s management, board of directors, and other stakeholders. You can even use your cash flow statements to create a cash flow forecast or projection. A cash flow projection lets you estimate the money you expect to flow in and out of your business in the future.

This Post Has 0 Comments